Or Have a Question: (316) 869-0948

: (316) 869-0948

: (316) 869-0948

PRE-FILE 2290 for 2025-2026

PRE-FILE 2290 for 2025-2026

Pre-file IRS Form 2290 Online and get your IRS Authorized 2290 Watermarked Schedule 1 from July 1st.

Pre-File Form 2290 Online for the current tax year 2025-2026. Truckers can easily File 2290 Online for the upcoming tax year. Truckers can now Pay Heavy Highway Vehicle Use Tax before the tax season starts. Get your IRS Authorized 2290 Schedule 1 Proof in the first week of July. HVUT Form 2290 for 2026 is easy with all the benefits and also at a low cost. E File Form 2290 now without any hurry. You have a lot of time to report all your heavy vehicles to the IRS. The heavy vehicle use tax payment can finish without any rejection if you choose Pre-Filing Form 2290. As you will get much time to File 2290 Tax Online with the Prefiling, you can easily check the details before you send them to the IRS.

Truck holders can Pre-File 2290 Online for 2025-2026 now. Form 2290 Due Date begins on July 1st. Before the 2290 Due Date begins, the truckers can pre-file their 2290 form online. The form2290filing.com will help you at every moment to pre-file 2290 online at a low cost.

It is really difficult to E File 2290 Form at the 2290 Form Due Date in a hurry. Truckers can't run their vehicles without having the proof of payment. If you want to get 2290 Schedule 1 Proof, you have to File IRS Tax Form 2290 Online. To get it without any difficulty, you need to go with the pre-filing 2290 Online for 2025-2026. You will get many benefits with Pre-File Form 2290 Online for 2025-2026.

The Pre-Filing Form 2290 is nothing but an early filing. Tax returns can accept before the 2290 Due Date begins. Form 2290 Schedule 1 Proof will reach you when the July weeks start. By choosing Pre-File Form 2290 for 2025-2026, you can avoid the rush at the 2290 Form Deadline. Also, you can save money by avoiding penalties. Furthermore, truckers can have enough time and also money with the Pre-Filing 2290 Online.

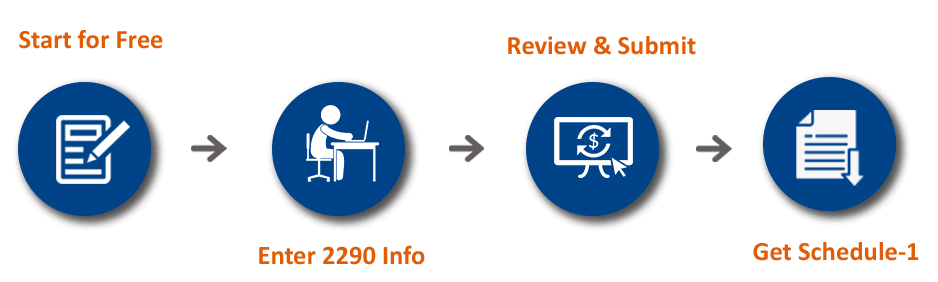

Truckers must Pre-File 2290 in an online. To Pre-File 2290 Form Online 2025-2026, you need to go with the simple steps. Before you go with the pre-filing 2290 form online, have a look at the filing process. There is no much difference between normal filing and pre-filing. Truckers can normally report their vehicles with the Pre-File 2290 Tax Online. It is easy to go with the filing process if you choose the best 2290 Online Provider. Pre-File Form 2290 Online for 2025-2026 and have easy and successful reporting of your vehicles.

The truck holders must pre-file 2290 online 2025-2026 from the IRS Authorized 2290 E File Provider. Not all the 2290 Online Providers may provide the option of pre-filing 2290 Online. Therefore, truck holders must check the option and go with the 2290 Form Pre-Filing 1 2026. The form2290filing.com is one of the best place to Pre-File Form 2290 Online. We are accepting Form 2290 Pre-File for the 2025-2026 tax year. Therefore, truck holders can easily File 2290 Form Online 1 2026 now and stay relax at their home.

Truck holders can Pre-File Form 2290 Online now. You can get your 2290 Schedule 1 Proof which is authorized by the IRS at the beginning of July month. Also, you can receive mail or fax of IRS Form 2290 Schedule 1 once the IRS accepts your 2290 Tax Form 2026. You can resolve many issues with the Pre-File Form 2290 Online 2025-2026. Therefore, without any latte, File 2290 Form Online now.

Truckers can easily avoid the last-minute filings with the pre-file form 2290. Also, truck holders cannot stop their vehicles on the road to report their vehicles to the IRS in the filing season. Also, you can't even think about the Form 2290 Filing when you are on the road with the pre-file form 2290 2026. You can easily receive your 2290 Schedule 1 Proof when the tax season begins. Therefore, there is no waiting or no tension of rejection. You can definitely get your 2290 Proof of payment on time. If you don't get the 2290 Schedule 1 Proof, then you need to wait until the 2290 Deadline. If you do not receive it before the 2290 deadline, then you need to pay penalty in case of Form 2290 Rejection. Therefore, to avoid all these problems, truckers must Pre-File Form 2290 Online 2025-2026.

What do I need to start my Pre-File Form 2290 Online for 2026? Truckers can easily start their Form 2290 Online Filing. But when you don't have any important requirements in the middle of the filing process, you will face many problems. If it comes with the problem of EIN, then you will definitely cross the Form 2290 Due Date and leads to Pay 2290 Tax Online. Therefore, truck holders must know the requirements for Pre-File Form 2290 Online 2026 and make their filing easy and safe. Avoid all the rejections by gathering the necessary requirements for Pre-File Form 2290 Online. File 2290 Online 2026 now and get out of the rejections of IRS 2290 Online Filing.

Alert for all the truckers!! Now you can report your heavy vehicles without waiting until 2290 Deadline or due date. You can report your vehicles now and have a lot of time to report your heavy vehicles to the IRS. You can File Form 2290 Online 2026 today without waiting for a single second. How to Pre-File 2290 Form Online for 2026? Where to Pre-File 2290 Online? Truck holders can choose the best Form 2290 Online Provider and File Tax Form 2290 Online for 2026 2026.

A trucker can Pre-File IRS Form 2290 Online now easily from the form2290filing.com and report their vehicles to the IRS. Just by following simple three steps, truck holders can File Form 2290 Online and Pay Heavy Vehicle Use Tax. The steps are explained below to Pre-File IRS Form 2290 Online for 2025-2026. You can finish the three steps and stays relax to travel with your vehicles.

As you start your registration process in the normal filing, you need to create a free account to pre-file form 2290 online. If you already registered on our website form2290filing.com, then there is no requirement of creating a new account. Open your 2290 account and go with the further process. The truckers who are reporting for the first time required email, phone number, and password. Fill these three fields and finish your registration process. After you log in, your dashboard will open and you can go with the next steps of the filing process.

Mainly, you have a doubt about the difference between normal filing and pre-filing. Truck holders can File Form 2290 Online in the 2290 Due Date in the tax season and they can file 2290 before the 2290 due date in the pre-filing. Therefore, the only difference will rise in the tax season. You can go with a similar process of 2290 Online Filing as you do in regular time. We added the 2025-2026 tax year along with the previous tax years. You can select the 2026 tax year to Pre-File IRS Form 2290 Online 2026. The remaining details are similar as you report your vehicles before.

The requirements for the Form 2290 Online Filing are VIN, EIN, Gross Weight of the Vehicle, Logging Vehicles, and Address. If you want to report multiple vehicles at a time, select the bulk upload option and upload the file once. In the bulk upload, you can report many vehicles at a single time.

The final step in the Pre-Filing Form 2290 2026 is making a payment. You can select the best Form 2290 tax Payment Option and pay 2290 online 2026. You can have three different payment options to Pay 2290 HVUT Online. Select any one of them as per your convenience and pre-file form 2290 online.

Note: The credit or debit card payment is not accepted to Pay 2290 Online 2026 as per IRS rules. Therefore, select any one of the payment options from EFTPS, EFW, or Check or Money Order and pay 2290 HVUT Online for 2025-2026.

You can also Pre-File Form 2290 Online 2026 for now and Pay 2290 tax on season time on form2290filing.com. As you will have much time due to Pre-File Form 2290, you can modify any of your details if it is necessary. Also, with our audit check option, we will help you to avoid errors and also inform you about any missing information in the IRS Tax Form 2290.

After you successfully finish your 3 Steps to Pre-File Form 2290 Online 2026, we will transmit to the IRS. Once the IRS accepts your form 2290 online filing return, you will instantly get your Form 2290 Schedule 1 Proof with IRS Authorized Watermark.

Truckers can easily File 2290 Tax Form 2290 Online for 2026 tax year. The 2290 Online Filing is easy if they begin with the form2290filing.com. The simple steps will help you to get IRS Form 2290 Schedule 1 Proof. You will begin your 2290 Tax Online Filing with free registration and ends by getting the proof of payment. But in the pre-File 2290 Online, you will report and submit your 2290 Form Online. But the 2290 proof of payment will reach the beginning of July. Truckers can have a huge time to File or do 2290 amendments in minutes. Also, truckers can claim credit or make VIN Correction with easy reporting of Pre-File 2290 Tax Form Online.

The filing process is simple and easy on our website. You can freely register on our website and go with the further process of pre-filing. Truckers can finish their filing process by providing all the necessary information in the filing process. Then, go with the payment process by selecting one of the best payment methods.

Truckers can have efficient and successful Form 2290 Online Filing for 2026 tax year by entering the below-required details in the Tax Form 2290.

1. VIN and EIN

2. Name and Address of your Trucking Business

3. The Gross Weight of the Vehicle

Truck holders can enter the VIN in the IRS Tax Form 2290 2026. Truckers must enter the Unique Vehicle Identification Number and report their vehicles to the IRS. Every individual vehicle has a unique VIN. Every single digit of VIN is important in the Pre-File Form 2290 Online 2026. Because a single wrong digit of the VIN leads to the rejection of your 2290 Online Filing. Therefore, enter the correct VIN and finish your filing.

The EIN is nothing but the Federal Tax Identification Number needs for the Pre-File Form 2290 Online. The EIN plays an important role in the Form 2290 Pre-Filing 2026. If you don't enter the correct EIN or entered not updated EIN, then you will not get the Tax 2290 Schedule 1 Proof. Truck holders face rejection if they enter the wrong EIN. Also, truckers who don't have EIN must apply it now. Because the IRS will take 15 days of time to assign EIN. Immediately apply an EIN if you don't have an EIN.

All the heavy vehicles and their gross weight mention in the IRS Tax Form 2290. Truck holders must Pay 2290 Tax according to the gross weight of the vehicle. You can use our 2290 Tax Calculator to calculate the amount you need to pay 2290 online for 2026.

Truck holders must enter the correct address and also your name. Also, choose the 2026 tax year and first use the month as of July to Pre-File Tax Form 2290 Online for 2026.

Choose any one of the payment methods from EFW, EFTPS, Check, or Money Order methods and finish your payment process. Truck holders don't have an option to pay their 2290 tax with credit or debit cards.

Truckers can Pre-File Form 2290 Online with the cheapest price. You need to awake before you begin your 2290 Online Filing. Truck holders must E File 2290 in minutes by checking all the pricing details at different websites. Because some websites will make your form 2290 online filing at low cost and others impose a huge price. Therefore, you need to check the difference between prices and why they are imposing different prices on your filing process. Truck holders can't go through one website blindly to get the safe filing at a low price. Form 2290 Filing Fee and pre-filing are posses with different payments or they both have the same cost are the important criteria now. Because truckers must select the website according to its price and services are given to the truck holders.

Once you know why an online provider imposing the extra amount then you can decide either to pay that much amount or not? Also, you can see what features help you to get out of Form 2290 rejections and error-free filing. It is also important to take care of your personal details while going with one website. Security is also an important issue while Filing 2290 Tax Online. While coming to the Pre-File Tax Form 2290 Online for 2025-2026, you must see what the amount you are going to pay is and how you will get your proof of payment.

Truckers who are going to Pre-File Form 2290 online will face a high amount as a service fee. As it is the early filing, the online providers should keep your details with a secure database. Also, they need to check the common errors and process your 2290 tax Online Filing at the beginning of the Form 2290 Due Date. Also, many other responsibilities should take by the E File Providers to File 2290 Online with the pre-filing. Therefore, many of the 2290 Online Providers impose a high amount for pre-filing 2290.

Are you ready to know 2290 Pre-Filing 2026 on form2290filing.com? Do you believe if I say about 2290 Pre-Filing Price? It's absolutely free to Pre-File 2290 Online on form2290filing.com website. You need not pay even a single penny for Form 2290 Pre-File. You can also pay HVUT 2290 on the filing season. Truck holders can easily finish their Form 2290 Online Filing at the cheapest price on our website. Also, you will not impose extra pay for pre-filing at any moment. You can pay $9.99 for a single-vehicle as you do it on Form 2290 Online Filing Season.

Immediately open the IRS Authorized 2290 E File Provider form2290filing.com and go through your pre-filing 2290 Form Online for 2025-2026 tax year. You can easily avoid all the risks of 2290 Online Filing on our website. Low cost and high-security 2290 Form E Filing in minutes on our website. Also, you can get the full support from our customer support team to finish your 2290 Form E Filing.